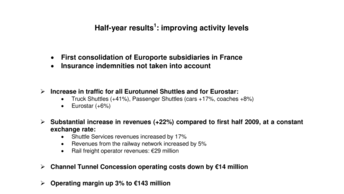

Half-year results: improving activity levels

- First consolidation of Europorte subsidiaries in France

- Insurance indemnities not taken into account

- Increase in traffic for all Eurotunnel Shuttles and for Eurostar:

-

-

- Truck Shuttles (+41%), Passenger Shuttles (cars +17%, coaches +8%)

-

-

-

- Eurostar (+6%)

-

- Substantial increase in revenues (+22%) compared to first half 2009, at a constant exchange rate:

-

-

- Shuttle Services revenues increased by 17%

-

-

-

- Revenues from the railway network increased by 5%

-

-

-

- Rail freight operator revenues: €29 million

-

- Channel Tunnel Concession operating costs down by €14 million

- Operating margin up 3% to €143 million

- The net result takes no account of insurance indemnities: loss of €45 million

The first half of 2010 has seen significant progress in all traffic (Eurotunnel Shuttles and Eurostar) and an increase in the Group’s revenues, despite the economic situation remaining difficult and the bad weather at the start of the year. The return of truck traffic increased during the second quarter. Results would have been higher had €48 million of indemnities for losses resulting from the fire in September 2008 not been blocked since May 2009.

Jacques Gounon, Chairman and Chief Executive of Groupe Eurotunnel SA, stated, “I am pleased that traffic and revenues have both increased in the current economic crisis. However, if our insurance payments remain blocked, we shall be unable to declare a profit this year”.

Key events in the first half year

- Eurotunnel continues its expansion through the acquisition of GB Railfreight Limited (GBRf), the third largest rail freight operator in the UK on 28 May 2010. This complements the existing rail freight business, Europorte France, to offer a complete cross-Channel rail freight proposition.

- Groupe Eurotunnel successfully tendered for the contract to manage the rail freight zone at the port of Dunkirk.

- Wind farm inaugurated on Coquelles terminal.

- In preparation for the London 2012 Olympic Games Eurotunnel has installed living quarters to enable a permanent military presence on the terminal in Coquelles.

- Having been selected to join the MSCI Global and MSCI Growth indices, on 10 February, Groupe Eurotunnel became part of the CAC Next 20 on the NYSE Euronext, from 22 June.

- Eurotunnel is also part of a British consortium bidding to acquire High Speed 1, which is being sold by the UK Government.

Improving activity levels

Eurotunnel continues to demonstrate its significant presence in the cross-Channel market with very strong growth in both Shuttle Services (cars and trucks) and in the number of Eurostar passengers. During the first half-year, despite the bad winter weather and following the closure of air transport as a result of the volcanic eruption in Iceland, like for like growth has been significant, with a substantial 11% increase in revenues at a constant exchange rate, with a notable contribution from Eurotunnel’s Shuttle Services (+17%). Market share recovery continues following the fire in September 2008, which resulted in one section of the Tunnel being unavailable until February 2009, and which had an important impact on commercial services.

The cross-Channel truck market continues to be affected by the economic situation, with a decline in the market estimated at 17% for the first half of 2010 compared to 2008. Truck Shuttle traffic, however has increased by 41% compared to the first half of 2009 (+35% in the first quarter and +48% in the second).

With the consolidation of Europorte and its subsidiaries (€29 million) since 1 January 2010, the increase in Eurotunnel’s revenues is 22%. However, GBRf is not yet consolidated.

Revenues resulting from the use of Eurotunnel’s railway network increased by 5%, stimulated by Eurostar’s performance which was helped by the Icelandic volcano.

Costs under control

During the first six months, the Concession’s operating costs were reduced by €14 million, of which €5 million came from the reduction in insurance premiums. The increase in staffing costs is directly related to the increase in size of the Group through the acquisition of Europorte’s French subsidiaries which brought c. 600 new staff.

The operating margin (EBITDA) is €143 million, an increase of 3% compared to the first half of 2009, despite the absence of insurance indemnities for operating losses following the fire in September 2008, even though an amount of €37 million was taken into account in the first half of 2009.

Excluding insurance indemnities in the first half of 2009, and with all else being equal, the EBITDA increased by 39%.

The net result shows a loss of € 45 million compared to the €5 million loss for the first half of 2009. This result is impacted by two main elements: the increase in financial charges linked to the increase in inflation, particularly in the UK, and the absence of payments from the insurers.

The cash situation has improved, with cash of €281 million at 30 June 2010, after the purchase of GBRf for €30 million; the net cash inflow for the first half of 2010 was €17 million.

Appendix 1: traffic and revenue tables for the first half of 2010

Appendix 2: half-yearly financial report for the six months to 30 June 2010

Get the full results in the attached document.