-

Our GroupA pioneer in the movement to bring people, goods, data and energy closer together, Getlink has been a major player in European history for 30 years.

-

Strategy and sustainabilityBy its very nature, Getlink is a low-carbon transport operator, and from the outset it has placed environmental, social and societal issues at the heart of its concerns.

- News

-

Shareholders and InvestorsIndividual shareholders, institutional investors, members of the financial community, Getlink provides you with its reference documents and useful information.

- Debt holders

-

- Annual financial reports

- Half-year financial reports

- Quarterly financial information

- Corporate governance reports

- Information relating to the total number of voting rights and issued share capital

- Press release announcing the formalities for obtaining or consulting the Universal Registration Document

- Share buyback programme

- Share buy back weekly reports on transactions on own shares

- Press releases identified as Inside information

- Prospectus

- Career

-

PressWhat's new at Getlink? Innovations, decarbonization of the transport sector... find here the latest news and media from the Group.

-

Our GroupA pioneer in the movement to bring people, goods, data and energy closer together, Getlink has been a major player in European history for 30 years.

-

Strategy and sustainabilityBy its very nature, Getlink is a low-carbon transport operator, and from the outset it has placed environmental, social and societal issues at the heart of its concerns.

- News

-

Shareholders and InvestorsIndividual shareholders, institutional investors, members of the financial community, Getlink provides you with its reference documents and useful information.

- Debt holders

-

- Annual financial reports

- Half-year financial reports

- Quarterly financial information

- Corporate governance reports

- Information relating to the total number of voting rights and issued share capital

- Press release announcing the formalities for obtaining or consulting the Universal Registration Document

- Share buyback programme

- Share buy back weekly reports on transactions on own shares

- Press releases identified as Inside information

- Prospectus

- Career

-

PressWhat's new at Getlink? Innovations, decarbonization of the transport sector... find here the latest news and media from the Group.

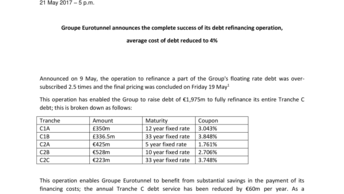

Groupe Eurotunnel announces the complete success of its debt refinancing operation, average cost of debt reduced to 4%

Announced on 9 May, the operation to refinance a part of the Group's floating rate debt was over-subscribed 2.5 times and the final pricing was concluded on Friday 19 May1

This operation has enabled the Group to raise debt of €1,975m to fully refinance its entire Tranche C debt; this is broken down as follows:

This operation enables Groupe Eurotunnel to benefit from substantial savings in the payment of its financing costs; the annual Tranche C debt service has been reduced by €60m per year. As a consequence, the average cost of the Group's debt reduces by approximately 200 bps, to below 4%.

The increase in cash of around €260 million generated by the operation will also ensure optimum conditions for the financing of ElecLink

Jacques Gounon, Chairman and Chief Executive Officer of Groupe Eurotunnel SE, stated:

"Our refinancing has been subscribed at advantageous interest rates, proof that the markets have confidence in the Groups outlook and that our debt has been normalised. The savings generated will create a great deal of value".

Important disclaimer:

This information is an inside information under article 7 of EU regulation 596/2014.

- The issuer of the new debt is Channel Link Entreprises Finance plc (CLEF)

- Home

- Press

- All our press releases and news

- Groupe Eurotunnel announces the complete success of its debt refinancing operation, average cost of debt reduced to 4%